Whether you’re buying your very first home or you’re a seasoned mover looking for your fourth, one question remains the same: How much home can I afford? It’s one of the most important questions in the homebuying journey and the answer depends on more than just what you want to spend. It’s about what you can comfortably afford while maintaining a healthy financial future. Let’s break it down.

Start With a Big-Picture Financial Review

Before browsing listings or daydreaming about your ideal kitchen island, start by reviewing your full financial picture. Ask yourself:

- What’s my total household income?

This includes salary, bonuses, side hustles, and any consistent passive income. - How much have I saved for a down payment?

Most conventional loans require 5-20%, though there are options with lower minimums. - Do I have funds for closing costs?

These typically range from 2-5% of the home’s price and they’re often overlooked. - What about my current debts?

Student loans, credit cards, car payments – your debt load affects your loan eligibility and monthly affordability. - How much do I need in reserve?

Lenders often like to see a cushion, enough to cover a few months of mortgage payments in savings.

The biggest is usually the down payment, which can range from as little as 3% to 20% of the purchase price depending on your loan type. You’ll also need earnest money, a good faith deposit that shows the seller you’re serious, which is typically 1% to 3% of the purchase price. Home inspections and appraisals are additional expenses that usually fall to the buyer, and while they may feel like extra steps, they’re critical for protecting your investment. Don’t forget other possible upfront expenses like option fees, credit report fees, and closing costs not covered by the seller. Having a clear picture of these initial costs will help you budget wisely and avoid surprises once you’re ready to make an offer.

💡 Pro Tip: Track your expenses for 2-3 months before buying. Many buyers are surprised at how much “invisible spending” (subscriptions, takeout, impulse buys) impacts what they can really afford. Avoid making any major purchases (Cars or large furniture, no new loans)

The 4 Parts of a Monthly Mortgage Payment (PITI)

When calculating what you can afford, remember that your monthly mortgage includes more than just the loan amount. It’s commonly referred to as PITI:

- Principal : The amount you’re borrowing.

- Interest : What the lender charges to loan you the money.

- Taxes : Property taxes vary by location and are often bundled into your mortgage. (in Texas, property tax rates often range 1.6-3.5%).

- Insurance : This includes homeowner’s insurance and, sometimes, PMI.

Private Mortgage Insurance (PMI) is a type of insurance that protects the lender, if you stop making payments on your loan.- When it applies: Most lenders require PMI if your down payment is less than 20% on a conventional loan.

- How much it costs: PMI usually ranges from 0.3% to 1.5% of the loan amount per year, added to your monthly mortgage payment. For a $250,000 loan, that could be $60 – $300 per month.

- How to remove it: Once you’ve built up 20% equity in your home (through payments or appreciation), you can usually request to have PMI removed. Some lenders will automatically cancel it when you hit 22% equity.

Why Getting Pre-Approved Early Matters

One of the smartest early moves is getting pre-approved (not just pre-qualified) for a mortgage. This step tells you and your real estate agent how much home you can realistically buy, based on your financials. Pre-qualification is an estimate based on self-reported numbers. Pre-approval involves documentation like pay stubs, tax returns, and a credit check. It gives you verified buying power. *Final clear to close verification will be completed again closer to closing.

Having a pre-approval in hand also strengthens your offer in a competitive market. Sellers are more likely to choose a buyer who comes with a pre-approval letter; it shows you’re serious and financially ready. From a seller’s perspective, accepting an offer means temporarily taking their home off the market and potentially missing out on other interested buyers. They want confidence that the deal will move forward smoothly. A pre-approval helps prevent surprises (like a loan denial during escrow) that can derail the transaction and cost everyone time and money. It gives all parties peace of mind from the start.

Key Factors Lenders Use to Determine Affordability

Every buyer’s situation is different, but mortgage lenders tend to focus on a few common affordability factors:

1. Gross Monthly Income

Your total income before taxes. Lenders typically recommend your monthly housing payment not exceed 28 – 31% of this amount.

💡 Buyer Tip: If you earn $6,000 per month, aim to keep your housing costs around $1,680 – $1,860.

2. Debt-to-Income Ratio (DTI)

This ratio compares your monthly debts to your monthly gross income. A lower DTI means you’re more likely to qualify for a larger loan amount. Ideally, your DTI should be under 36 – 43%, depending on the loan type.

💡 Buyer Tip: Paying down even one credit card can lower your DTI and boost your buying power.

3. Down Payment Amount

The more you can put down upfront, the less you’ll need to borrow. A larger down payment can also help you avoid private mortgage insurance (PMI) and may qualify you for better interest rates.

💡 Buyer Tip: Explore down payment assistance programs, grants, or gift funds. First-time buyers in Texas may qualify for state-supported options. Retirement accounts like a 401(k) can sometimes be tapped into for a down payment. Always check repayment rules and tax considerations before borrowing.

4. Credit History and Score

Your credit score affects both your loan eligibility and the interest rate you’ll receive. Higher credit Score = lower interest = lower monthly payments.

💡 Buyer Tip: Check your credit report early to correct errors before applying.

5. Interest Rates

Rates fluctuate with the market. Even a small increase in rates can make a significant difference in your monthly payment and overall affordability.

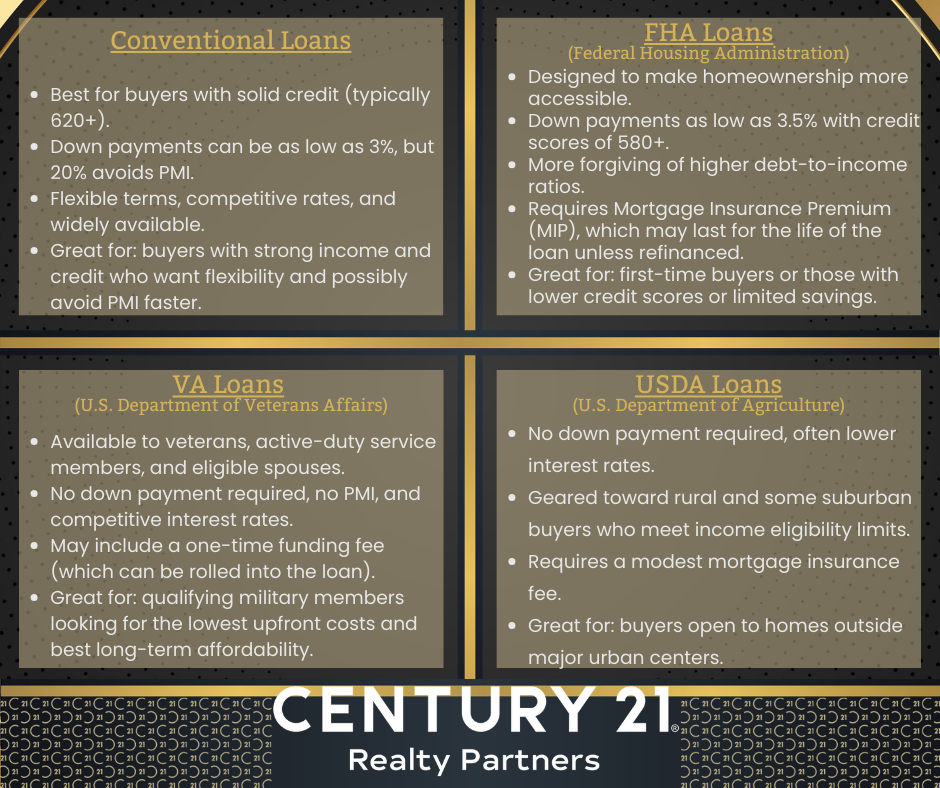

6. Loan Type

There are many types of loans: Conventional, FHA, VA, USDA, and more. Each has different requirements for credit score, down payment, and debt ratios. Based on the type of property you are purchasing (Single Family/Condo) also influences which loan options are available to you.

Now, Let’s Think Beyond the Mortgage

While PITI forms your mortgage payment, homeownership comes with additional expenses that should be taken into consideration and calculated, such as:

- HOA fees (often $200 – $400 per month in Houston communities)

- Utilities and maintenance (average Houston electric bills can top $150 – $200 per month in summer)

- Landscaping and lawn care (Pool Care/Pest Control)

- Home repairs and improvements (plan 1 – 3% of home value per year)

- Emergency fund savings

Especially for first-time buyers, it’s important to factor in these ongoing costs to avoid stretching your budget too thin. Keep in mind that not all of these expenses will apply to every property. For example, some communities don’t have an HOA, while condos or townhomes may cover landscaping or exterior maintenance as part of their association fees. Even so, these are important factors to keep in mind and questions worth asking as you compare homes. Knowing what’s included (and what isn’t) can help you budget more accurately and avoid surprises down the road.

Use an Affordability Calculator

Not sure where to start? Try using a Home Affordability Calculator to plug in your income, debt, and savings. It’ll give you a realistic price range to guide your home search. Remember: These types of calculators only give estimates. A conversation with a mortgage professional will give you real numbers, tailored to your specific situation.

💡 Pro Tip: Run “what if” scenarios. What if interest rates rise by 1%? What if your household income changes? Planning ahead protects you from surprises.

Extra Perks: Cash Back Programs You May Qualify For

When you’re calculating how much home you can afford, don’t forget to explore the bonus opportunities that could put money back in your pocket after closing. Through C21 Realty Partner’s affiliation with the Anywhere Leads Network, some buyers may qualify for special programs that offer cash back or other financial benefits after closing.

A few examples include:

- NFCU Realty Plus – For Navy Federal Credit Union members looking to maximize their savings.

- AARP Real Estate Benefits – Tailored perks for AARP members ready to make a move.

- Cooper Cashback – A lender program offering cash rewards after closing, giving your budget a little boost.

- Military Real Estate Benefits – Support and savings designed for active duty service members, veterans, and their families (even distant family).

Every buyer’s situation is different, so it’s important to speak with your trusted Century 21 Realty Partners agent. We’ll walk you through which programs you may be eligible for and help you take advantage of the benefits available, because finding the right home is even better when you’re getting money back at closing.

Final Thoughts

Buying a home is both exciting and emotional, but keeping a clear eye on your budget helps ensure long-term happiness instead of financial headaches. The home you can afford today should also leave room for tomorrow’s goals, whether that means kids, pets, career changes, or retirement savings. Understanding your budget empowers you to make smart, confident decisions.

While upfront and ongoing costs may feel daunting, real estate remains one of the most reliable ways to build lasting wealth. Preparing in advance sets you up for success, and as your home’s value grows, you’ll have the option to upgrade to a larger space or a better location. More importantly, homeownership allows you to build equity, a financial asset that provides stability today, be borrowed from tomorrow and can be passed on to future generations.

Still have questions? Let’s connect.

We are here to guide you through every step, from first budget to final signature and beyond.

💻 Contact@C21RealtyPartners.com

👉 C21RealtyPartners.com

📞 281-252-4122

This is such good advise and a great place to start the process of finding your next home!