When you think about your home’s roof, you probably picture shingles, gutters, and the occasional leak after a heavy Houston downpour. But did you know that your roof plays a major role in your homeowners insurance costs and coverage options? Whether you are a current homeowner or in the market to buy, understanding this connection can save you thousands of dollars and a lot of headaches.

Why Your Roof Matters to Insurance Companies

Insurance providers in the Houston area evaluate your roof closely because it is your home’s first line of defense against wind, hail, and heavy rain. If your roof is in poor condition or made from materials prone to damage, your insurance premiums may be higher. In some cases, an insurer could even refuse coverage until the roof is repaired or replaced.

A newer, well-maintained roof made of durable materials such as metal or architectural shingles is often rewarded with lower rates. Insurers see these roofs as less likely to require expensive claims in the near future.

Age & Condition: A Risk That Grows with Time

In Houston, many insurance companies start to take a closer look once a roof reaches 10 to 15 years old. While this does not mean your coverage will automatically change, it can mean higher premiums or reduced coverage for older roofs. For example, some policies may only cover the depreciated value of an older roof rather than the full replacement cost.

If you are buying a home, be sure to ask about the roof’s age, material, and any recent repairs. Getting a professional inspection can help you understand both the current condition and the potential insurance implications. In Houston’s tropical climate, standard 3-tab shingles often last only 12 to 18 years, while architectural shingles stretch to about 15 to 25 years. That is shorter than national averages, so knowing your roof’s birthdate is not just helpful, it is essential.

Materials Matter: Longevity, Resilience & Discounts

The material of your roof can make a difference in how your insurance company views risk. Impact-resistant materials may qualify you for discounts, while roofs that are susceptible to wind or hail damage may not fare as well.

Metal roofs and high-quality asphalt shingles generally perform better in hurricanes and hailstorms compared to low-grade shingles or wood shake roofs. Some insurers in Texas offer specific discounts for roofs that meet impact-resistance standards set by organizations such as UL (Underwriters Laboratories).

Here is how materials stack up in Houston:

- 3-Tab Shingles: 12 to 18 years

- Architectural Shingles: 15 to 25 years

- Luxury Shingles (high-end, mimicking slate or wood): 30 to 50 years

- Metal Roofs: 50 to 70 years, with some variants lasting even longer

Metal roofs can also cut energy costs by reflecting heat, lowering cooling bills by up to 40% in summer.

Hiring Tip: Always get multiple quotes from licensed and insured Houston roofing contractors. Ask about warranties and reviews to ensure you’re working with a reputable company. Also be sure to consult with your HOA on permitted roofing styles in your specific development.

Deductibles & Coverage: Its Not Personal, But it’s Real

Insurance companies often view a proactive approach to roof repairs as a sign of lower risk. Keeping documentation of repairs, inspections, and upgrades can help if you ever need to dispute a claim decision. The deductible you pay after a claim often ties directly to your roof’s risk level:

- 1% used to be standard

- Now 2% is common

- In high-risk areas, deductibles may climb to 3% to 5%

That means a $300,000 insured value could require a $6,000 to $15,000 out-of-pocket hit. Insurers may automatically assign ACV (actual cash value) instead of RCV (replacement cost) for older roofs, which reduces your payout significantly. For example, If your 10-year-old roof has depreciated to a value of $4,000, and your deductible is $2,000, your insurance might only cover $2,000, leaving you to pay $5,000 out of a $7,000 replacement.

If a home has a history of frequent roof-related insurance claims, it can impact your future premiums. This is another reason why it is important to understand the roof’s condition before buying and to keep up with routine maintenance. Wind and hail damage are legally considered Acts of God, so insurers cannot single you out. However, regional claims after storms can often push rates upward across entire neighborhoods.

Insurance Costs Are Rising – Fast

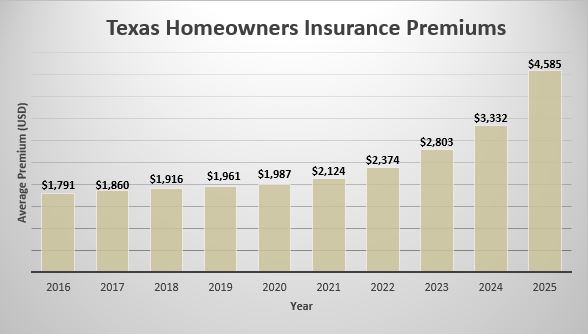

Texas homeowners face soaring insurance costs due to inflation, tougher weather, and rising rebuild expenses. The average premium in Texas hit $2,803 in 2023, while on the high end, some homeowners in Houston now pay $10,000 to $15,000 per year.

Average home insurance premiums are already among the highest in the country. Rising material costs, including an estimated $11,000 increase from tariffs, have pushed rates higher each year. According to Nerdwallet 2025 Premiums are already up by 37.6% compared to last year. By the end of 2025, some projections suggest homeowners could pay about $6,718 annually, roughly an 82% jump from earlier averages.

Tips to Stay Ahead, Whether You Own or Plan to Buy

- Know your roof’s age and material before you buy or renew.

- Start budgeting for replacement as roofs near that 12 to 20 year mark in Houston.

- Opt for impact-resistant materials and keep the paperwork for insurer credits.

- Document roof condition with photos, reports, and inspection records.

- Get quotes before renewals; switching policies could save you thousands.

- Schedule annual roof inspections to identify issues early.

- Keep gutters clean to prevent water backup and roof damage.

The Bottom Line

Your roof is not just a weather shield. It influences your insurance eligibility, coverage levels, and premiums. Something else to consider while budgeting home expenses when purchasing a new home. In Houston’s dynamic market, knowing and planning for these factors can save you thousands and keep your coverage secure. Whether you are protecting your current home or searching for your next one, your roof is a key player in your insurance costs and your peace of mind.

Ready to Make Your Next Move Smartly?

At Century 21 Realty Partners, we understand that a roof is not just part of your home, it is part of your financial strategy. Whether you are buying, selling, or just exploring, our local expertise helps you optimize for insurance, resale value, and long-term peace of mind.

Let’s talk, because in Houston, every detail matters. Reach out today, and let’s make your next move a roof-smart one.

💻 Contact@C21RealtyPartners.com

📞 281-252-4122

Additional Resources

Texas Department of Insurance – Insurance and your roof

Stormersite – Check Hail History

ValuePenguin – Compare Home Insurance Quotes

Yelp Reviews – Shop Roof Repairs

Nerdwallet – Average Homeowners Insurance by State

Houston Roofing Services – Roof Replacement Costs by Square Foot

Angi – Houston Roof Replacement Average Cost

M&M Roofing Texas – Roof Replacement Cost Factors

Royal Roofing Texas – Material Cost Guide

Achilles Roofing TX – Full Cost Breakdown

Ruff Roofing – Per Sq Ft Cost Guide